IRS 5173 2008-2026 free printable template

Show details

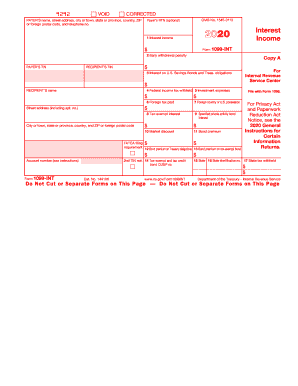

5173 Form (Rev. July 2008) Department of the Treasury Internal Revenue Service Transfer Certificate DATE OF DEATH ESTATE OF RESIDENCE AT TIME OF DEATH By direction of the Commissioner of Internal

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign irs form 5173

Edit your how do i get form a year or even longer form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 5173 pdf form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 5173 form online

Use the instructions below to start using our professional PDF editor:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit irs 5173 form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form 5173 irs

How to fill out IRS 5173

01

Obtain IRS Form 5173 from the IRS website or local IRS office.

02

Provide personal identification information, such as your name, address, and taxpayer identification number.

03

Clearly state the tax year for which you are submitting the information.

04

Fill in the appropriate sections regarding your income and deductions.

05

Review the form for accuracy to ensure all information is correct.

06

Sign and date the form before submission.

07

Submit the form to the specified IRS address listed in the instructions.

Who needs IRS 5173?

01

Taxpayers who are claiming certain tax credits or deductions related to specific income situations.

02

Individuals or businesses who received notices from the IRS requesting additional information for tax assessment.

03

Those who are adjusting their tax returns from previous years.

Fill

irs transfer certificate form 5173

: Try Risk Free

People Also Ask about 5173 transfer certificate

Does the IRS issue tax clearance certificates?

If you're a resident or a nonresident alien departing the United States, you usually have to show that you have complied with the U.S. income tax laws before you can depart. You do this by obtaining from the IRS a tax clearance document, commonly called a departure permit or sailing permit.

What is a IRS transfer certificate?

A transfer certificate will be issued by the Service when satisfied that the tax imposed upon the estate, if any, has been fully discharged or provided for.

What is legal form 5173?

It is an IRS document, specifically, Form 5173. It is used to confirm through the IRS that there is no estate tax due, or it's already been paid. The certificate allows the financial institution off the hook for taxes.

What is a tax clearance letter from the IRS?

What is a Tax Clearance Letter? A tax clearance letter is the written certification that is issued by the IRS, once the required federal estate tax return has been filed. This clearance letter says that the IRS has accepted your tax returns. An estate cannot be closed in probate until this letter is issued.

How do I get Form 5173?

You must file Form 706-NA to obtain IRS Form 5173. This can be a lengthy process. The IRS admits that the process can take a year or even longer.

How long does it take to get an IRS transfer certificate?

The time frame for the IRS to process the affidavit and supporting documents is six to nine months from the time the IRS receives all necessary documentation.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my form 5173 transfer certificate directly from Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your i need irs form 5173 as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

How can I send pdffiller for eSignature?

When you're ready to share your transfer certificate form 5173, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

How do I complete legal form 5173 on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your irs form 5173 instructions, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.

What is IRS 5173?

IRS Form 5173 is a tax form used to report the contributions made to a Coverdell Education Savings Account (ESA). It is primarily used for tracking educational savings.

Who is required to file IRS 5173?

Individuals who have made contributions to a Coverdell ESA and are required to report those contributions to the IRS need to file Form 5173.

How to fill out IRS 5173?

To fill out IRS Form 5173, you must provide personal information such as your name, address, and Social Security number, along with details about the contributions made to the Coverdell ESA throughout the tax year.

What is the purpose of IRS 5173?

The purpose of IRS Form 5173 is to ensure that contributions to a Coverdell ESA are reported accurately to the IRS and to facilitate proper tracking of education savings contributions for tax purposes.

What information must be reported on IRS 5173?

Information that must be reported on IRS Form 5173 includes the amounts contributed to the Coverdell ESA, the name of the beneficiary, the account number, and any other relevant details pertaining to the contributions.

Fill out your IRS 5173 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Irs Transfer Certificate Form is not the form you're looking for?Search for another form here.

Keywords relevant to how to fill out irs 5173 text obtain irs form 5173 from the irs website or local irs office undefined

Related to form 5173 instructions

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.